United States Consumer Confidence Weakened By Reduced Job Availability

Consumer Confidence in September 2025

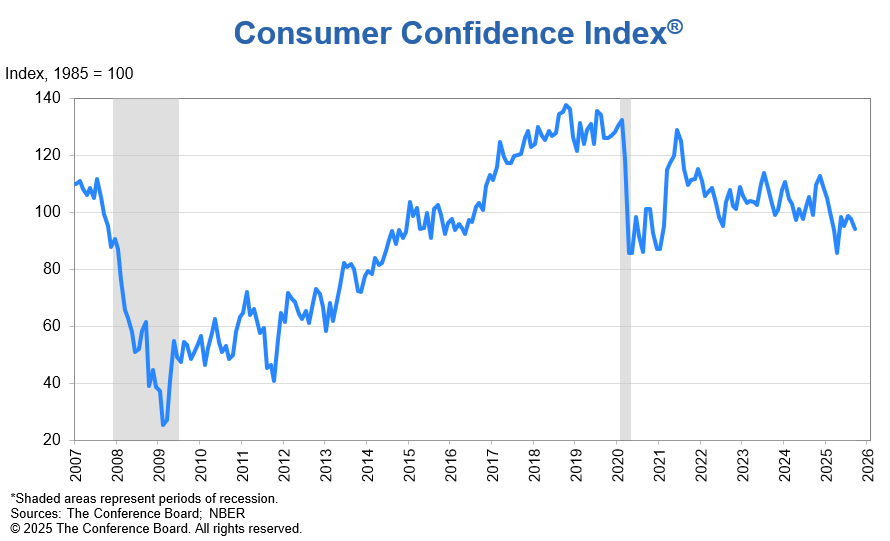

Consumer confidence in the U.S. declined noticeably, thanks in part to a shaky job market. According to MarketWatch’s latest report, confidence levels have dipped by 3.6 points to 94.2, the lowest point since April of 2025. This demonstrates the close link between the job market and the broader U.S. economy.

Consumer confidence measures how consumers feel about their financial well-being and the economy as a whole. Based on this definition, we see people aren’t feeling as confident in the economy or their own financial situation. This points to a likely slowdown in the U.S. economy as consumers become more cautious with their spending.

The Influence of Job Availability on Consumer Sentiment

The availability of jobs and consumer confidence tend to move together. When one declines, so does the other. When workers see fewer employment opportunities, consumer sentiment suffers. This means people will ‘tighten their belts’ and spend less, just in case their financial situation worsens in the future. Larger purchases like major appliances, cars, and homes could suffer.

Economic Uncertainties Driving Down Consumer Confidence

There are other factors that contribute to the uncertainty consumers are feeling. Inflation and volatile stock markets are major contributors to this decay in confidence.

Addressing these concerns requires targeted strategies, such as ensuring job market stability and increasing financial security, to support a more positive financial climate.

Navigating the Road Ahead

The latest dip in consumer confidence is due to job market issues. The path forward involves strategic interventions from both the public and private sectors. By focusing on job stability and financial security, confidence levels can be improved, paving the way for more robust economic health.